We still have availability at the following sessions. Book now to avoid disappointment! (Please book via the new CRM).

|

New Councillor Session |

7th February |

6:00pm-9:00pm |

Zoom |

|

Coming soon - Elections Workshop |

February - TBC |

|

|

|

Planning for councils |

21st February |

7:00pm-9:30pm |

Zoom |

|

Allotments (Day 1 of 3) – Tenancy and Policies |

1st March |

2.00pm-3.30pm |

Zoom |

|

Allotments (Day 2 of 3) – Site Facilities and Health & Safety |

8th March |

2.00pm-3.30pm |

Zoom |

|

First Aid At Work |

14th March |

9.30am-4.30pm |

The Old School, Dunholme, LN2 3QR |

|

Allotments (Day 3 of 3) – Self-management for Association Councils |

15th March |

2.00pm-3.30pm |

Zoom |

|

LCC websites – Jadu Basics |

21st April |

10.00am-4.00pm |

Zoom |

|

LCC websites – Jadu Advanced |

26th May |

10.00am-12.30pm |

Zoom |

|

Play Area Inspections |

7th June |

9:30am-4:00pm |

North Hykeham Town Council Civic Offices, Fen Lane, North Hykeham, LN6 8UZ |

|

Play Area Inspections (with exam) |

8th June |

9:30am-4:00pm |

North Hykeham Town Council Civic Offices, Fen Lane, North Hykeham, LN6 8UZ |

***Training venues are booked once a number of bookings have been received. This allows LALC to book venues based on where the majority of delegates are travelling from. If there are less than 10 bookings on any course, the course will automatically be held at the LALC Office, 8 Market Rasen Road, Dunholme, Lincoln, LN2 3QR***

We are currently working on the training programme for the next quarter – look out for further dates being published.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Position | Closing date | |

Clerk/RFO | No closing date | |

Administration Assistant | 29th November | |

South Luffenham Parish Council (Rutland) | Clerk/RFO | No closing date |

Clerk/RFO | No closing date | |

Clerk/RFO | 31st December | |

Clerk/RFO | 12th December | |

Administration Assistant | 31st December | |

Clerk/RFO | 14th December | |

Allotments Officer | 2nd January | |

Clerk | 31st January |

|

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Cost of Living updates

Useful Cost-of-Living Support information and links can be found on the new LALC website:

https://lalc.jams.junari.com/cost-of-living-challenge

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

LALC Christmas opening

|

The LALC office will close on Friday 23rd December and re-open on Tuesday 3rd January. The next eNews will be published on Monday 9th January. On behalf of Katrina, Andrew, Lindsey and Elaine, LALC would like to wish everyone a Merry Christmas and Happy and Peaceful New Year. |

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

National Survey – Council expenditure on solicitors

We are working with County Association colleagues to build a picture of how much the 10,000 parish and town councils in England spend each year on solicitors for things like land transfers, lease agreements, contracts and procurement, legal disputes, and general legal advice. Please look up the approximate total value of your legal services spend during the financial year ending 31 March 2022 and report the data via https://www.surveymonkey.co.uk/r/PC5QJ6P. Please respond by 31 December 2022 if possible. The data will be used purely for illustration; no personal information is being collected and no contact will be made with individual councils. We will feedback the overall results in the New Year.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Grants of up to £100,000 Available for Community Facilities (England)

Registered Charities, churches, Parish Councils, Local Authorities and CASC registered sports clubs can apply for grants of between £2,000 and £100,000 for the provision, maintenance or improvement of community facilities.

This can include:

· Village Halls and Community Centres

· Public Play Areas

· Publicly available Multi use games areas

· Skate parks and BMX tracks

· Sport and recreation grounds including pavilions and clubhouses with full public access

· Churches – community spaces only

· Nature Reserves

· Public gardens, parks, country parks and woodlands with at least dawn to dusk access

· Museums

The funding is being made available through the FCC Community Action Fund and is available to projects located within 10 miles of an eligible FCC Environment site.

The fund is currently closed but will re-open for applications from the 21st December until 5pm on the 8th March 2023.

The application form is available on the FCC Community Foundation website (link below).

Useful Links: Application Guidelines

Organisation name: FCC Community Foundation

Deadline: 08-03-2023

Link: https://fcccommunitiesfoundation.org.uk/funds/fcc-community-action-fund

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Multiply Maths Skills Survey

Multiply Numeracy Skills

Multiply is a national initiative. It supports people to understand and work with numbers in everyday life. The programme aims to spark better opportunities and brighter futures. Lincolnshire County Council has successfully secured £4 million to deliver Multiply across the county.

We want to do all we can to make learning easy to access and fit into people's lives. We want to make sure that we deliver the learning people need in the way they need it.

We would like people to complete a short survey so we can gather your views and experiences. Your feedback will help shape the development and delivery of this three-year programme. There are two surveys available. The first is aimed at the public. The second is aimed at employers and business owners.

The survey should take about five minutes: https://www.letstalk.lincolnshire.gov.uk/multiply-numeracy-skills

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

COUNCIL NEWS

DECEMBER 2022

1 Conducting Redundancy Consultation

The first three months of the year are often the time when larger Councils consider restructuring their workforce in anticipation of the new financial year. There are many reasons for this to happen between January and March, such as funding for particular posts coming to an end, the Council wanting to stop loss making activities or simply restructuring what they do.

However, if restructuring also entails making staff redundant, the process is not a risk-free option. Any Employee with two or more years continuous employment could claim Unfair Dismissal if the process is mishandled. One of the key elements of any redundancy process is meaningful consultation.

For a Council to simply resolve that a post or posts are no longer needed, and to inform Employees that they will be leaving at the end of the Financial Year without prior explanation or entering into dialogue before making that decision, is failing to deliver that consultation and creates an Unfair Dismissal.

This was recently tested in case law (Teixeira v Zaika Restaurants) following a dismissal over the phone of a chef who was less experienced than their colleagues. The Employer’s defence was that consultation would always have been meaningless, as the job had ended and there were no other options available for consideration.

The Court disagreed with the Employer’s failure to consult and ruled that the purpose of the process was to test an assumption that there was no further need for an Employee, and in this case the Employee was denied that opportunity. The purpose of consultation is to challenge the reasons for proposing redundancy and consider alternative jobs or opportunities.

By denying Employees an opportunity to engage in a dialogue over these options, removes the possibility of them coming up with ideas that could have avoided the redundancy.

Consequently, taking the unilateral decision to dismiss without consultation constitutes Unfair Dismissal.

2 Could Requiring someone with a Disability to attend a Redundancy Consultation meeting constitute Disability Discrimination?

Yes, if the disability places someone in an unfavourable position in attending the meeting, as was determined in the case of Hilaire v Luton Borough Council.

If an Employee has a disability that affects their communication skills, ability to fully understand what is being discussed, or they have a mental health problem that could be exacerbated by attending the meeting, the need to attend a consultation interview could be a discriminatory practice.

A Council faced with such a dilemma would be wise to make reasonable adjustments to help accommodate the Employee through the process. This could involve getting an informed medical opinion from their GP, or an independent Occupational Health Specialist, as to what such adjustments could be. Possible options could be to allow the Employee to be accompanied by an advocate/Union Representative, attend via Zoom/Teams, conduct the meeting in a neutral venue, conduct it at a time of day that is more accommodating to the Employee. Whichever option a Council choses to use would depend on the medical advice.

Statutory Payment Rates from April 2023

Shared Parental Pay (ShPP) Statutory rate of £172.48 or 90% of employee’s weekly earnings if lower. 6 weeks at 90% of average weekly earnings. Then statutory rate of £172.48 or 90% of employee’s weekly earnings if lower. 6 weeks at 90% of average weekly earnings. Then statutory rate of £172.48 or 90% of employee’s weekly earnings if lower. Statutory rate of £172.48 or 90% of employee’s weekly earnings if lower. Statutory rate of £172.48 or 90% of employee’s weekly earnings if lower. |

Statutory Sick Pay (SSP) £109.40 pw for 28 weeks subject to earnings (average £123 per week) |

Minimum Wage from April 2023 Workers aged 23 and over (National Living Wage) £10.42/hour Workers aged 21–22 £10.18/hour Workers aged 18–20 £7.49/hour Workers aged 16-17 £5.28/hour Apprentices under 19, or over 19 and in first year £5.28/hour |

PROFILE

Chris Moses LLM Chartered FCIPD is Managing Director of Personnel Advice & Solutions Ltd. He is a Chartered Fellow of the Chartered Institute of Personnel and Development, and has a Master’s Degree in Employment Law. If you have any questions regarding these issues please feel free to contact him on (01529) 305056 or email p.d.solutions@zen.co.uk

www.personneladviceandsolutions.co.uk

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

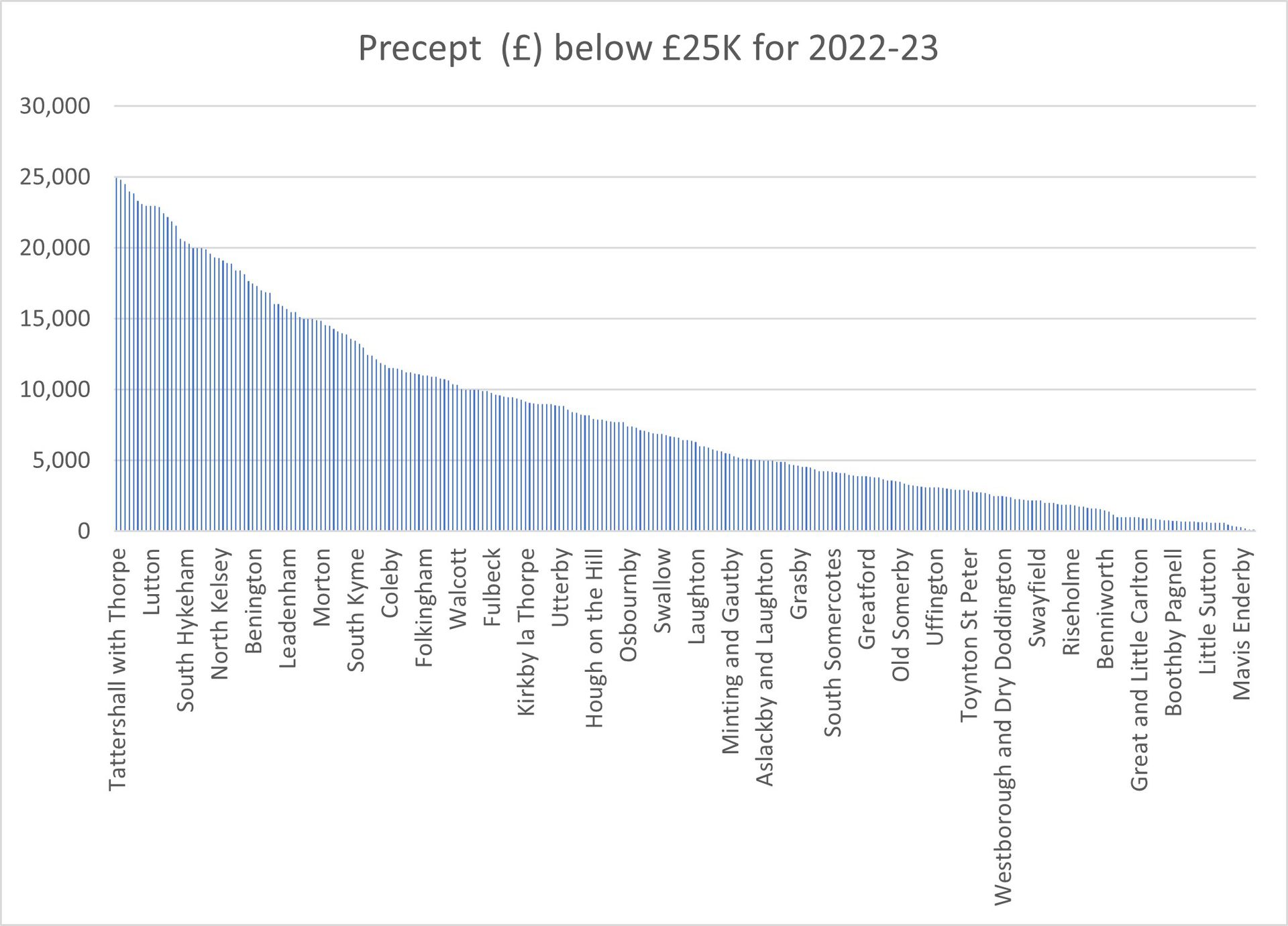

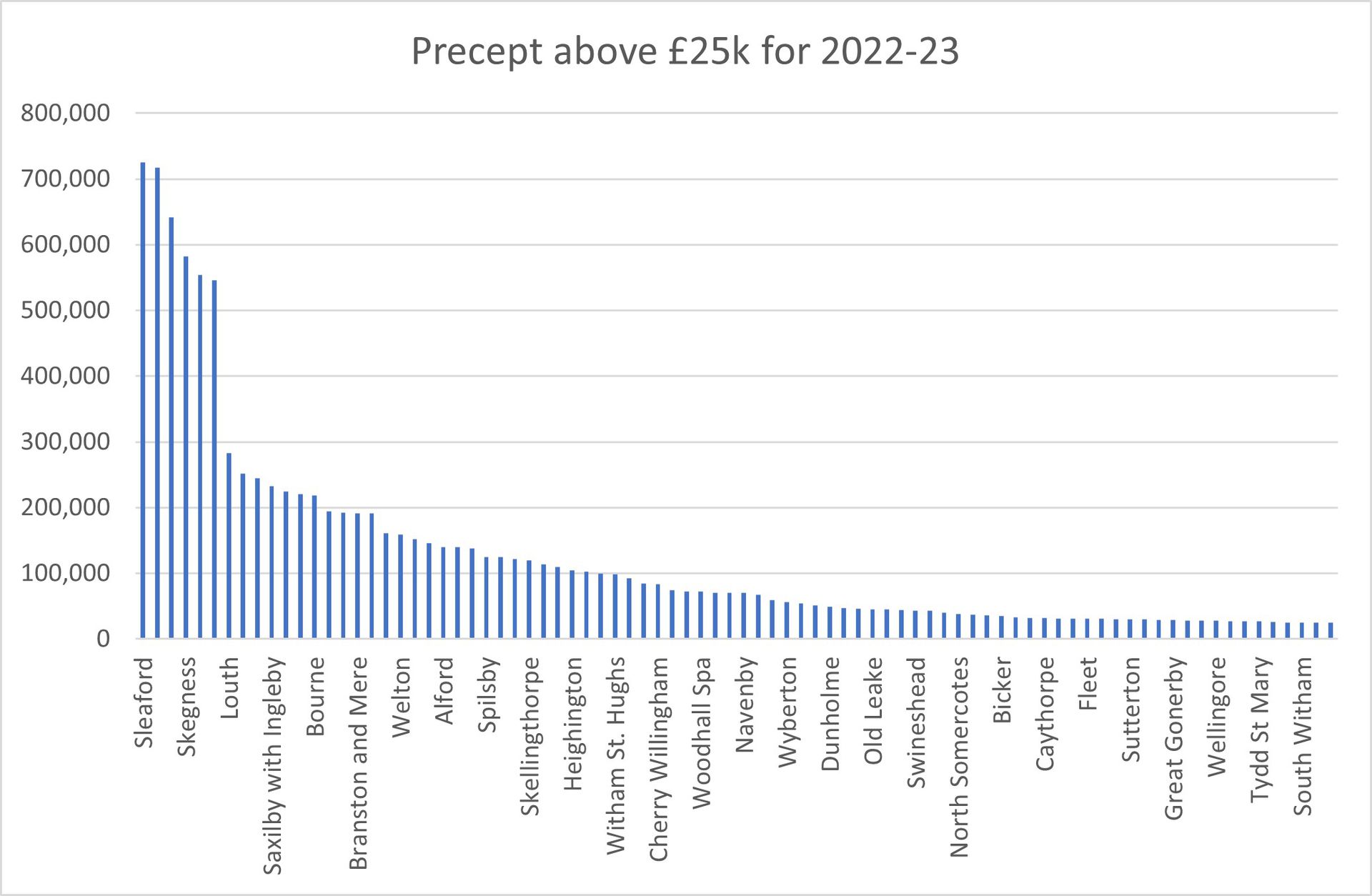

Council Tax Precepts in Lincolnshire 2022-23 financial year

District | Parishes | Precepts | CTAX base | Precept Total |

ELDC | 163 | 101 | 43511 | £3,205,980 |

Boston | 18 | 18 | 10454 | £500,607 |

SHDC | 22 | 22 | 19903 | £1,014,815 |

NKDC | 71 | 70 | 38267 | £3,911,969 |

WLDC | 128 | 79 | 29707 | £2,333,818 |

SKDC | 83 | 72 | 48261 | £1,937,112 |

| 485 | 362 | 190103 | £12,904,300 |

There are over 500 parishes in Lincolnshire, but some are in ‘groups’ so the total in the data is 485. Not all parishes issue a precept. The amount of money raised by the parish and town councils in Lincolnshire through their precepts is nearly £13million. The council tax base is the number of equivalent Band D properties in a parish and there are over 190,000 in Lincolnshire (all Band A to Band H properties are calculated as a proportion of a Band D dwelling – Band A, for example, is just 0.67 of a Band D and Band H is weighted double a Band D dwelling).

From the above figures the average band D council tax figure for Lincolnshire parish and town councils is £67.88 and the average precept is £35,647. Further analysis of the data shows that there is wide variation with large town councils needing to precept up to £725,000 while hundreds of the small parish councils raise a precept of below £10,000. The precept represents the amount to be raised from council tax and is the difference between the budgeted expenditure and the budgeted income approved by each council. All councils are required by law to approve a budget each year.

|

20 Highest Precepts in Lincolnshire 2022-23 |

||

|

District |

Parish/Town Council |

Precept |

|

North Kesteven |

Sleaford |

£725,100 |

|

North Kesteven |

North Hykeham |

£716,933 |

|

East Lindsey |

Mablethorpe and Sutton |

£641,463 |

|

East Lindsey |

Skegness |

£582,578 |

|

West Lindsey |

Gainsborough |

£554,258 |

|

South Kesteven |

Stamford |

£546,048 |

|

East Lindsey |

Louth |

£283,063 |

|

South Kesteven |

Market Deeping |

£252,000 |

|

South Holland |

Holbeach |

£244,341 |

|

West Lindsey |

Saxilby with Ingleby |

£233,130 |

|

North Kesteven |

Ruskington |

£224,888 |

|

East Lindsey |

Horncastle |

£220,875 |

|

South Kesteven |

Bourne |

£218,110 |

|

North Kesteven |

Washingborough |

£194,639 |

|

North Kesteven |

Waddington |

£191,895 |

|

North Kesteven |

Branston and Mere |

£191,313 |

|

West Lindsey |

Nettleham |

£191,298 |

|

South Kesteven |

Deeping St James |

£161,458 |

|

West Lindsey |

Welton |

£159,010 |

|

North Kesteven |

Bracebridge Heath |

£152,025 |

|

20 Lowest Precepts in Lincolnshire 2022-23 |

||

|

District |

Parish/Town Council |

Precept |

|

South Kesteven |

Boothby Pagnell |

£750 |

|

North Kesteven |

Culverthorpe and Kelby |

£724 |

|

East Lindsey |

Gayton le Marsh |

£700 |

|

North Kesteven |

Stapleford |

£700 |

|

South Kesteven |

Dunsby |

£700 |

|

South Kesteven |

Careby Aunby and Holywell |

£700 |

|

North Kesteven |

Newton Haceby and Walcot |

£658 |

|

North Kesteven |

Aunsby and Dembleby |

£658 |

|

South Holland |

Little Sutton |

£650 |

|

South Kesteven |

Burton Coggles |

£600 |

|

East Lindsey |

Aby with Greenfield |

£600 |

|

South Kesteven |

Little Ponton and Stroxton |

£600 |

|

North Kesteven |

Aswarby and Swarby |

£592 |

|

West Lindsey |

Broadholme |

£500 |

|

South Kesteven |

Wyville cum Hungerton |

£400 |

|

East Lindsey |

North Cockerington |

£350 |

|

East Lindsey |

Mavis Enderby |

£300 |

|

West Lindsey |

Heapham |

£200 |

|

West Lindsey |

Saxby |

£150 |

|

South Holland |

Surfleet |

£120 |

Mapping all of the precepts onto graphs shows that councils set a precept around their particular community needs – there is little bunching around certain figures. The services provided by parish and town councils range from providing regular public meetings for the community to consider their local issues, noticeboards, newsletters, benches, defibrillators, planning consultations, recreation and sports grounds, community buildings, street cleansing, cemeteries, local grass-cutting, bus shelters, community events, community speedwatch and some services that have been delegated or handed over from District and County Councils. Most councils employ a Clerk/ Responsible Financial Officer and internal auditor.

The precept increased in most councils this year

24 councils reduced their precept by between £1 and £6,000

96 councils did not change their precept amount

233 councils increased their precept by between £1 and £49,429

The average increase in precept was £3,220.

The average change in the total precepted amount for Lincolnshire was 5.96% including all increases, no change and decreases.

Many increased precepts rose 10% or more in individual parishes indicating they were covering cost of living increases, embarking on a project, purchasing a specific item or introducing a new service or building up reserves for future projects.

Analysis of the data shows that the precept varies considerably from council to council. Larger town councils precept more than smaller parish councils. However, they will have larger tax bases so the amount charged for a Council Tax Band D dwelling appearing on the council tax bill may be still relatively low. Some parishes have a growing tax base because of new development so even if the precept increases the Band D council tax amount may remain the same or reduce as the precept is being shared over more households. The five highest Band D council tax amounts in Lincolnshire are

Bassingham (North Kesteven) £168.17

Mablethorpe and Sutton (East Lindsey) £164.77

Washingborough (North Kesteven) £155.38

Saxilby with Ingleby (West Lindsey) £152.00

Auborn with Haddington (North Kesteven) £139.77.

Council Tax Precepts in Lincolnshire 2022-23 financial year:

|

Boston |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

1 |

£42.23 |

£42.23 |

£42.23 |

£3,674 |

£3,674 |

£3,674 |

|

101-500 |

10 |

£126.33 |

£16.25 |

£76.44 |

£35,500 |

£3,250 |

£20,595 |

|

501-1000 |

6 |

£69.66 |

£55.33 |

£45.69 |

£45,000 |

£29,768 |

£37,384 |

|

1000+ |

4 |

£48.27 |

£14.06 |

£37.28 |

£85,000 |

£31,249 |

£54,054 |

|

East Lindsey |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

23 |

£60.87 |

£5.07 |

£17.88 |

£4,508 |

£300 |

£1,007 |

|

101-500 |

59 |

£82.19 |

£10.90 |

£37.08 |

£35,958 |

£1,760 |

£7,409 |

|

501-1000 |

9 |

£138.58 |

£28.21 |

£68.87 |

£125,000 |

£20,000 |

£49,687 |

|

1000+ |

9 |

£164.77 |

£41.43 |

£94.06 |

£641,463 |

£72,100 |

£251,459 |

|

South Holland |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

1 |

£18.06 |

£18.06 |

£18.06 |

£650 |

£650 |

£650 |

|

101-500 |

7 |

£80.36 |

£0.25 |

£41.24 |

£9,462 |

£120 |

£13,682 |

|

501-1000 |

7 |

£56.74 |

£27.09 |

£37.80 |

£47,000 |

£14,576 |

£28,103 |

|

1000+ |

7 |

£77.83 |

£12.73 |

£50.45 |

£244,341 |

£14,500 |

£93,805 |

|

North Kesteven |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

15 |

£68.72 |

£8.66 |

£30.86 |

£6,460 |

£592 |

£2,375 |

|

101-500 |

37 |

£139.77 |

£23.31 |

£72.34 |

£28,072 |

£2,807 |

£15,616 |

|

501-1000 |

5 |

£168.17 |

£55.39 |

£91.45 |

£92,999 |

£31,407 |

£61,509 |

|

1000+ |

13 |

£155.38 |

£80.18 |

£111.65 |

£725,000 |

£12,397 |

£230,077 |

|

West Lindsey |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

20 |

£123.15 |

£4.75 |

£40.45 |

£9,900 |

£150 |

£2,975 |

|

101-500 |

45 |

£128.99 |

£11.76 |

£53.41 |

£37,400 |

£1,900 |

£11,626 |

|

501-1000 |

7 |

£100.32 |

£25.38 |

£60.13 |

£99,900 |

£18,400 |

£45,849 |

|

1000+ |

7 |

£152.00 |

£60.02 |

£103.18 |

£554,528 |

£70,200 |

£204,312 |

|

South Kesteven |

Band D council tax amount |

Precepted Amount |

|||||

|

Tax base |

Councils |

Highest |

Lowest |

Average |

Highest |

Lowest |

Average |

|

0-100 |

18 |

£62.34 |

£8.76 |

£26.15 |

£5,000 |

£400 |

£1,938 |

|

101-500 |

37 |

£90.19 |

£8.61 |

£41.34 |

£25,000 |

£1,600 |

£8,929 |

|

501-1000 |

11 |

£60.34 |

£16.60 |

£40.66 |

£50,950 |

£14,000 |

£28,751 |

|

1000+ |

6 |

£109.79 |

£3.99 |

£51.43 |

£546,048 |

£33,000 |

£209,269 |

NB. LALC provides this information in good faith and is not responsible for inaccuracies and calculating errors. The information is indicative and has not been audited.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

What is the ‘council tax base’?

We are at the time of year when parish and town councils are sent the details of the council tax base for their parish area. This short article gives an insight into how the tax base is calculated.

Nationally there are approximately 25milliion dwellings of which 24.4million are liable for council tax; 16million are liable to pay 100% council tax and nearly 8.5million have a 25% single person discount. There are approximately 700,000 exempt properties, 500,000 empty properties and 250,000 second homes.

The tax base is the number of properties in the parish/town council area expressed as a number of Band D properties. Every dwelling has been given a council tax band from Band A to Band H and these have to be converted into a proportion of Band D. A Band A property is six-ninths of a band D property whereas a Band C is eight-ninths of a band D property. A Band G property is fifteen-ninths of a Band D. The table below shows these amounts in decimal format (rounded to 2 decimal places).

|

Band |

Band D equivalent |

Band |

Band D equivalent |

|

A |

6/9ths = 0.67 |

E |

11/9ths = 1.23 |

|

B |

7/9ths = 0.78 |

F |

13/9ths = 1.45 |

|

C |

8/9ths = 0.89 |

G |

15/9ths = 1.67 |

|

D |

9/9ths = 1 |

H |

18/9ths = 2 |

The council tax base figure that you receive from the District Council is a calculation taking into account the above conversion rates less single person discounts, exemptions, council tax support, disabled band reductions, plus any empty property premiums, and new dwellings to come into the list multiplied by the collection rate.

A simplified example calculation for a 200-household parish could be as follows:

• 150 dwellings in band A x 0.67 = 100.5

• 20 dwellings in band B x 0.78 = 15.6

• 10 dwellings in band D x 1 = 10

• 20 dwellings in band H x 2 = 40

The initial parish tax base is 166.1 so when reduced by 50 single person discounts (50 x 0.25) of 12.5 and 4 x new band D properties are added to the list with an estimated collection rate of 98% the calculated tax base is 154.45.

If the precept for that parish council is £5000 the Band D equivalent amount will be (£5000 divided by 154.45) £32.37 per Band D property.

Using the above table, it is then possible to calculate how much each dwelling will pay on their council tax bill for each council tax band because Band D is 1 at £32.37 then Band A properties will be 0.67 of that amount £21.58 and a Band G property will be 1.67 of the Band D amount £54.06.

|

A |

B |

C |

D |

E |

F |

G |

H |

|

£21.58 |

£25.25 |

£28.81 |

£32.37 |

£39.82 |

£46.94 |

£54.06 |

£64.74 |

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

URGENT CORRESPONDENCE FROM BRUNO PEEK LVO OBE OPR PAGEANTMASTER

RE: FORTHCOMING CORONATION OF HIS MAJESTY KING CHARLES III.

I am sure you would have seen through the media, our past, most gracious Queen Elizabeth undertook the lighting of her Principal Beacon at Windsor Castle on 2nd June this year, an honour we will all never forget, especially as it was one of her last official engagements before her sad passing.

However, the important reasons for contacting you are as follows.

(1) To thank you, your City, Borough, Town, Parish or local community, and the many, many thousands of others that supported you again, in taking part in the lighting of the Beacons and associated events, including the Commonwealth Song, Proclamation, Bugle Call and those Pipers and others around the world who took part in this celebration. We will not see another Platinum Jubilee for many generations to come, so your involvement was even more important, and is now part of history.

(2) We have received so many calls and emails from previous participants, asking if Beacons are being planned to be lit in celebration of the forthcoming Coronation of King Charles III, in June next year. The answer from Buckingham Palace is NO, the reason being, they are conscious that the Coronation will take place less that a year after The Queen’s Platinum Jubilee Beacons were lit, and are therefore anxious to ensure that the events planned for May 2023 have a markedly different look to those of June 2022.

(3) IMPORTANT HOWEVER, it has been agreed that Beacons should be lit on 6th June 2024, as the PRINCIPAL LEADING event led by our communities and organisations etc, in the celebration/commemoration/tribute to D-Day 80, the 80th Anniversary of the D-Day landings in Normandy.

D-Day as you know, was the largest Naval, Air and Land operation in history, so we need to undertake this 80th Anniversary opportunity with great enthusiasm, saying thank you through respect/remembrance/tribute to many hundreds of thousands of souls who sacrificed so much to ensure the freedom/peace we all enjoy today.

With this in mind therefore, I will be sending an official Guide To Taking Part in D-Day 80 in the New Year, enabling us all to start our planning for this special occasion, involving all areas of our local communities and organisations throughout the UK, Channel Islands, and the Isle of Man, many of which, would have had relatives and loved ones involved 80 years ago.

The above logo, developed for D-Day 80 will be available for free use as soon as the Guide To Taking Part has been produced and published in the new year, includes the flags of the Nations involved in the landings on 6th June 1944. This will ensure they receive the correct acknowledgement for the amazing, selfless and important part they played, along with providing the opportunity to become involved in the celebrations/commemorations/tribute in 2024, if they so wish.

May I also take this opportunity to thank you once again for the amazing role you and your community/organisation, played in the great success of the Platinum Jubilee Beacons and its associated events this year, and to wish you and your family a very Happy Christmas and New Year.

My warmest regards,

Bruno Peek LVO OBE OPR

Pageantmaster

D-Day 80

6th June 2024

Telephone: + 44 (0) 7737 262 913

Email: brunopeek@mac.com

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Are your Financial Regulations up to date?

If your Financial Regulations include the procurement thresholds, please make sure that the values are up to date. These thresholds changed on 1 January 2022.

As per the revised briefing issued by Parkinson Partnership LLP in March:

Procurement Thresholds

The thresholds for public procurement have changed from 1 January 2022

Public contracts, with an estimated value (including VAT, from 1 January 2022):

over £213,477 (previously £189,330) for goods or services, or

over £5,336,937 (previously £4,733,252) for public works (construction),

must comply with the full requirements of the Public Contracts Regulations 2015. These include specific tendering methods and timescales, as well as a requirement to advertise on both the Contracts Finder website and Find-a-Tender (the UK e-notification service).

Where a contract will run for several years, it is the total (not annual) value that matters.

Where the estimated total value (including VAT) is below these thresholds, but exceeds £25,000, a council is required to advertise the opportunity on Contracts Finder if they publish an open invitation to quote/tender. If they are inviting specific firms and not opening up to wider competition, they don’t have to advertise the opportunity on Contracts Finder (Public Contracts Regulations 2015, Reg. 110(5)(b)).

However, a council must comply with its own Standing Orders and Financial Regulations and if those regulations require an open invitation and a formal tender process, the council should follow them. Tendering processes ensure fair competition, achieve value for money and avoid anti-competitive behaviour. They protect the council and taxpayers.

If a council simply chooses specific firms to invite, it must avoid allowing non-commercial considerations (defined in Part 2 of the Local Government Act 1988) to influence its decisions. If a council invites some suppliers and not others, it should record its reasons.

If the council genuinely believed the value would be under £25,000 but the tenders came in above that, the Regulations do not require it to go back and start again.

Regardless of whether the opportunity was advertised, Regulation 112 requires a council to publish the award of a contract over £25,000 on Contracts Finder within a reasonable timescale. There is no specified timescale for parishes, but we suggest within 3 months.

Disclaimer

This bulletin is only intended as a brief guide and councils should ensure they follow the Regulations and guidance on www.gov.uk, seeking professional advice if they are in any doubt. The Parkinson Partnership LLP accepts no liability for any loss arising from situations where councils have not followed the law and guidance.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Old LALC website to be switched off

Please note that the old LALC website will be switched off at the end of December and all training must be booked via the new CRM after that point.

For any clerks who haven’t received their access, or are having issues logging in, please contact us as soon as possible.

For those clerks who have already got CRM access, please ensure that contact details for your council and councillors are kept up to date, including any change of Chair. We regularly receive emails from ex-Chairs or ex-Councillors asking to be removed from our mailing lists and so would appreciate it if clerks keep their own council/councillor information up to date where possible.

The eNews is also available on the public-facing website each week under News. Let your councillors know.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

UK Prosperity Fund and Rural England Prosperity Funds

LALC has just been commissioned to provide three workshops for parish and town councils in East Lindsey, South Holland and Boston Borough Council areas to provide information about the grant funding parishes can apply for over and delivered over the next two financial years until March 2025.

Dates, venues and times are expected to be in January 2023.

Grant funding priorities are expected to be focussed on:

• Business ideas linked to health and well-being, food production, tourism, culture and the arts, transport, environmental businesses and the digital sector

• Social enterprises, i.e. businesses which have a social purpose and make a profit in a way that directly benefits society

• Projects on the Lincolnshire Coast which help more people between 16-64 to become economically active

• Projects which bring imaginative new activities and adapt buildings to breathe new life into town centres

• Programmes for smaller places which will improve and widen the use of community buildings including village halls

• Projects which increase the availability of decent broadband connectivity in rural places

• Focus on challenges of rural economy that could diversify and sustain farm/rural business incomes

• Need to upgrade/improve failing community infrastructure to tackle deprivation

• Support innovation to increase productivity.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Emergency Plans

Does your council have an Emergency Plan in place? Are you working towards putting an Emergency Plan in place? Are you currently reviewing your Emergency Plan?

Please let us know so that we can pass this information on to LCC Emergency Planning team.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Does your council have a ‘good news’ story or an example of best practice you’d like to share with other councils? If so, please let us know so that we can include it in a future edition of eNews.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

Heighington Parish Council – Festive Tea and Cake

Heighington Parish Council put on a festive tea and cake event for their elderly parishioners. As well as providing a warm space during one of the coldest days of the year, attendees had the chance to meet up and chat with friends, over a cup of tea and accompanied by mince pies and cakes. All in the festive atmosphere of the Jubilee Hall. Attendees also had a free go on the tombola – and everyone walked away with a present.

This event was made possible via a grant from AF Blakemore and Son Ltd, donated tombola prizes and the help of councillors, officers and volunteers. Surplus food and tombola prizes were donated to a local foodbank at Branston.

꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰꙰ ꙰꙰꙰

NALC Chief Executive's bulletin

Early Day Motion on standards in public life

A new Early Day Motion on intimidation in community, parish and town councils* has been tabled in parliament by Dr Julian Lewis MP. The motion is part of our work with the Society of Local Council Clerks (SLCC) through the Civility and Respect Project to press for the standards regime to be strengthened. So far, the new motion – which also calls for the Government to revisit its response to the Committee on Standards Life report – has been supported by 15 MPs, surpassing the number that signed a similar motion in the previous session of Parliament. We are working with SLCC colleagues to update template letters for local (parish and town) councils and clerks to use to write to their MPs seeking their support for the motion, and these will be available shortly.

*The Early Day motion is also available on the SLCC website (no login required):

https://www.slcc.co.uk/new-early-day-motion-has-been-tables-for-civility-and-respect-mps-urged-to-sign-again/

NALC in parliament

It was good to promote the first tier of local government in Westminster and Parliament this week and highlight several issues our local councils and communities are facing, including banking services, supporting communities with the cost-of-living crisis and funding. Between myself, NALC’s chair, Cllr Keith Stevens, and our head of policy and communications, Justin Griggs, we covered parliamentary events hosted by Localis, the localist think tank, UK Finance, the trade body for the banking and finance industry, and the All-Party Parliamentary Group for Rural Services. I was also pleased that Andrew Selous MP mentioned NALC and used our briefing in his adjournment debate on unadopted roads on 1 December, where he highlighted the need for developers, councils and highways organisations to work together to ensure residents are not paying twice for basic services.

A new online event on social isolation and loneliness

We've added a new online event on social isolation and loneliness from the local council perspective, which takes place on 22 February 2023. Social isolation and loneliness are two of the most significant health issues facing us. So why are social isolation and loneliness such a big problem? And how can local councils provide solutions? Join us to find out how to connect those suffering with practical and emotional community support and how local councils can explore options such as setting up a health and wellbeing board and employing health and wellbeing coordinators. Our online events are popular, so book soon to ensure you don’t miss out!

National Assembly

NALC’s National Assembly – our ‘big board’ which brings together councillors from each of the 43 county associations of local councils – met remotely on 6 December. Ahead of the draft minutes being available, here’s a summary:

• Chairs of committees gave an update on their work over the last quarter, which you can read more about in the agenda and supporting papers.

• Councillors reaffirmed their commitment to lobbying for local councils to have the flexibility to hold remote meetings and noted NALC was continuing to work with other local government bodies on this issue, activities have included securing nearly 40 written questions in Parliament, an amendment to the Levelling Up and Regeneration Bill (LURB) which while not pushed to the vote we will continue to seek change through the forthcoming stages, and raising the issue directly with the new local government minister who assured us a decision would be made shortly.

• The calendar of meetings for 2023 was agreed upon, and following discussion on increasing the number of physical meetings and a straw poll, it was agreed to hold one in-person meeting of the National Assembly in 2023/24, potentially including an overnight element.

• The National Assembly work programme for the upcoming year will include an informal meeting on the King’s coronation, the work of committees, NALC and county associations working together, task and finish group on governance, an in-person meeting, national networks, parliamentary event including Star Council Awards presentations, annual general meeting issues including affiliation fees, budget and motion, and governance elections.

• Owen Edwards from the Better Planning Coalition, which represents 30 organisations across the environment, housing, planning, heritage, and transport sectors, gave a presentation on their work and current priority of influencing the planning reforms contained in the LURB; there was support for NALC joining the coalition given NALC has many shared policy objectives.

NALC Finance and Scrutiny Committee

NALC’s Finance and Scrutiny Committee met remotely on 1 December. Councillors considered our overall finances, including the half-year accounts, which showed a small overspend for the 6 months against budget. Several large projects are underway, including the Civility and Respect Project, the new website, and the future of our existing office building, which will require close financial management as we approach the year's end. The committee also revisited the treasury management policy to consider updates from the last meeting, and further amendments were suggested to make processes clearer concerning due diligence and approval for new accounts.

Report of the Commission on the UK’s Future

Former prime minister Gordon Brown this week published his Report of the Commission on the UK’s Future, which makes recommendations on Lords reform, devolution of power and the future of the union. The report makes 40 recommendations on devolving power out of London to boost growth with “real and lasting economic and political devolution across our towns, communities and to people across the country”. All 40 recommendations will now be subject to consultation, with the conclusions likely ending in Labour’s manifesto. In his on-the-day response, NALC’s chair, Cllr Stevens, has welcomed many of the report's proposals, particularly the empowerment of local government. NALC’s Policy Committee will consider the report in detail at its next meeting in January.

NALC National Network: Women councillors

Cllr Sue Baxter, vice president, hosted the latest meeting of the NALC National Network: Women councillors on 7 December. Discussions included progress on the White Ribbon campaign, which has received support from both NALC’s Policy Committee and also the Management Board, who have agreed NALC would become an accredited organisation, plans to mark next year’s International Women’s Day, and an update from Michelle Moss, project manager, on the Civility and Respect Project where colleagues gave an update on sign-ups to the Pledge and provided positive feedback on the training courses.

On the blog: WorkNest

As people’s bills increase, so does the pressure on employers to offer some form of support. Hannah Copeland, HR Business Partner at WorkNest has written for the NALC blog about how employers can alleviate their workforce’s money worries and the benefits of doing so.

And finally…

December’s bi-monthly legal bulletin for county officers went out this week and covered annual council meeting dates for local councils with elections and the Coronation bank holiday, toilets at council premises, dogs at council meetings and powers to provide commercial bus services.

Jonathan Owen